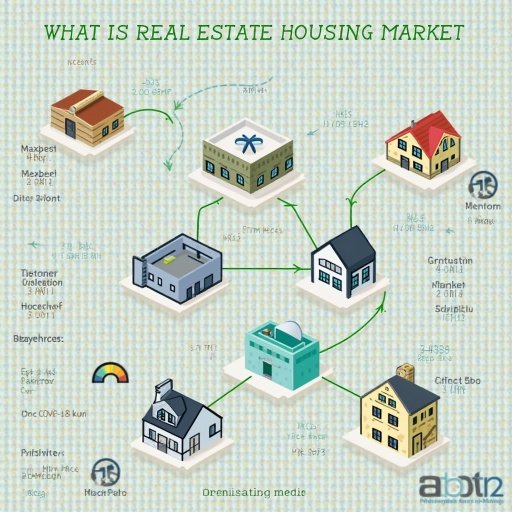

Understanding the Real Estate Housing Market

The real estate housing market is a dynamic ecosystem where residential properties are bought, sold, rented, and invested in. It is a complex interplay of economic, demographic, and geographic factors that influence property values, availability, and affordability.

What is Real Estate?

Real estate encompasses land and any permanent structures or improvements attached to it. This includes residential properties, commercial buildings, industrial facilities, and vacant land. The housing market specifically focuses on residential properties intended for habitation.

Key Components of the Housing Market

Supply and Demand:

The housing market’s equilibrium hinges on the delicate balance between the number of available homes and the pool of potential buyers. When this equilibrium is disrupted, it can significantly influence property values and overall market trends. A surplus of homes relative to buyers often leads to a decline in prices as sellers compete for limited interested parties. Conversely, a shortage of available homes in relation to eager buyers can create a seller’s market, driving prices upward due to high demand and limited supply. This dynamic interplay between supply and demand is a fundamental principle shaping the housing market’s trajectory.

Economic Indicators:

Interest rates, employment levels, consumer confidence, and overall economic health directly influence housing affordability and demand.

Demographic Factors:

Population growth, age distribution, household size, and migration patterns shape housing preferences and market segments.

Geographic Location:

The desirability and monetary valuation of a property are significantly influenced by a multitude of interconnected factors. The availability of employment opportunities within a region can substantially impact property values, as a robust job market attracts potential buyers and residents seeking stable livelihoods.

Similarly, climatic conditions play a pivotal role in shaping property desirability, with favorable weather patterns enhancing quality of life and increasing property appeal. The presence of essential amenities such as schools, healthcare facilities, shopping centers, and recreational areas significantly contributes to a property’s attractiveness and overall value. Furthermore, the quality and accessibility of infrastructure, including transportation networks, utilities, and communication systems, are crucial determinants of property desirability and can command premium prices for properties situated in well-connected areas.

Government Policies:

Zoning regulations, tax incentives, and housing programs can influence market dynamics and affordability.

Types of Residential Properties

The housing market comprises various property types to cater to diverse lifestyles and budgets:

Single-Family Homes:

Envision a residential tapestry woven with independent threads, each culminating in a self-contained dwelling. These solitary abodes, each guarded by its own private yard and accessed through a dedicated entrance, offer residents a haven of seclusion and personal dominion.

This architectural format fosters a profound sense of ownership and individual autonomy, empowering inhabitants to forge a unique relationship with their immediate surroundings. The clear demarcation between the private realm of these dwellings and the shared communal spaces beyond creates a harmonious balance, respecting the individuality of residents while nurturing a cohesive community fabric.

Condominiums:

Individually owned units within a larger building or complex, sharing common areas.

Townhouses:

Multi-story homes with shared walls and often a backyard or patio.

Apartments:

Apartment complexes, or apartment buildings, are structures containing multiple self-contained residential units designed for rental habitation. These individual units, commonly referred to as apartments or flats, share communal spaces within the building such as lobbies, hallways, and potentially a variety of amenities like fitness centers, swimming pools, or communal lounges. These residential complexes offer a diverse range of housing options to accommodate individuals, couples, and families with varying living space requirements and budgetary constraints. Apartment complexes provide a flexible and often cost-effective alternative to single-family homes, particularly in urban areas where land is limited and the demand for rental housing is high.

Mobile Homes:

Pre-fabricated homes placed on rented or owned land.

How the Housing Market Works

The housing market operates through a complex network of buyers, sellers, real estate agents, lenders, and investors.

Buying a Home:

Individuals or families typically obtain financing through mortgages and work with real estate agents to find suitable properties.

Selling a Home:

Sellers list their properties with agents, negotiate offers, and complete the sale process.

Rental Market:

Property owners, often termed landlords, engage in the practice of leasing their residential or commercial units to tenants. This arrangement constitutes a contractual agreement wherein tenants assume occupancy of the property for a predetermined period, typically in exchange for periodic rental payments. While landlords retain ownership of the property, they grant tenants exclusive possession and usage rights throughout the lease term.

This symbiotic relationship provides individuals and businesses with the opportunity to secure housing or workspace without the financial commitments and responsibilities inherent in property ownership. The landlord-tenant dynamic forms a cornerstone of the real estate market, facilitating the allocation and utilization of property resources while generating income for property owners.

Real Estate Investment:

Investors purchase properties for rental income, appreciation, or potential development.

Factors Influencing Housing Market Trends

Several factors contribute to fluctuations in the housing market:

Economic Cycles:

Recessions can lead to decreased home values and sales, while economic expansions often drive market growth.

Interest Rates:

Lower interest rates make mortgages more affordable by reducing the cost of borrowing money to purchase a home. With lower interest rates, potential homeowners can secure mortgages with smaller monthly payments, increasing their purchasing power. This affordability boost stimulates demand within the housing market as more individuals are able to qualify for homeownership, leading to increased property values and potentially fueling economic growth through related industries like construction and real estate services.

Consumer Confidence:

Optimism about the economy and job security can boost homebuying activity.

Inventory Levels:

A shortage of available homes can drive up prices, while an abundance can create a buyer’s market.

Government Policies:

Government interventions significantly shape housing market dynamics through various mechanisms. Tax deductions, such as mortgage interest deductions, incentivize homeownership, boosting demand and potentially inflating property values. Conversely, housing subsidies, like vouchers or tax credits, aim to increase affordability for low-income households, influencing rental markets and potentially mitigating displacement concerns.

Zoning regulations, which dictate permissible land use and development, exert profound control over housing supply and character. Restrictive zoning can limit construction, escalating housing costs, while permissive regulations may encourage denser, more affordable development but potentially alter neighborhood aesthetics. The interplay of these policies is complex, with outcomes hinging on factors like regional economic conditions, demographic shifts, and the specific design of the interventions themselves.

Natural Disasters:

Events like hurricanes or earthquakes can disrupt local housing markets.

The Importance of the Housing Market

The housing market plays a crucial role in the overall economy:

Job Creation:

Real estate-related industries employ millions of people.

Wealth Creation:

Homeownership stands as a cornerstone for constructing substantial wealth over time. As opposed to the transient nature of rental payments, each mortgage installment contributes directly to equity accumulation within the property. This equity growth, coupled with potential appreciation in home value, can significantly bolster an individual’s financial standing.

Moreover, homeownership often unlocks tax advantages and the ability to leverage home equity for substantial investments or during financial emergencies. While it demands responsible financial management and carries inherent risks, homeownership undeniably presents a powerful avenue for long-term wealth generation and financial security, making it a strategic choice for those seeking to build a robust financial foundation.

Economic Indicator:

Housing market trends can signal broader economic conditions.

Quality of Life:

Access to affordable housing is essential for individual well-being and community development.

Challenges in the Housing Market

The housing market faces various challenges:

Affordability:

The relentless ascent of home prices coupled with the persistent stagnation of wages has cast a long shadow over the American Dream of homeownership. This stark economic disparity has created a formidable barrier, rendering the prospect of owning a home increasingly unattainable for many.

As housing costs continue their upward trajectory, far outpacing the growth of incomes, the dream of establishing roots and building equity through homeownership has transformed into a distant mirage for a growing segment of the population.

This economic chasm has profound implications, forcing individuals to make agonizing choices between housing stability, savings, and other essential needs, while casting a pall of uncertainty over the future aspirations of countless would-be homeowners.

Housing Inventory Shortages:

Limited supply can drive up prices and reduce buyer choices.

Homelessness:

A lack of affordable housing contributes to homelessness.

Market Volatility:

Economic downturns and external shocks can cause market instability. These disruptions, whether originating from internal economic cycles or external forces, can trigger a chain reaction of events that destabilize markets. Economic contractions, marked by declining GDP, rising unemployment, and reduced consumer spending, create uncertainty and erode investor confidence, leading to volatile market fluctuations.

Additionally, external shocks such as natural disasters, geopolitical tensions, or global pandemics can disrupt supply chains, increase commodity prices, and create unforeseen economic challenges. These factors collectively contribute to market instability, characterized by rapid price swings, increased volatility, and potential asset bubbles or crashes.

Check also:How to become a real estate agent

Conclusion:

The real estate housing market is a complex and dynamic ecosystem where economic, social, and demographic forces converge to shape its trajectory. This intricate interplay of factors profoundly influences decisions related to buying, selling, renting, or investing in residential properties. Understanding the market’s nuances requires a keen awareness of economic indicators, demographic trends, consumer preferences, and government policies.

Furthermore, the housing market serves as a barometer for broader economic health, with fluctuations in property values and housing affordability impacting consumer confidence, spending patterns, and overall economic growth. As such, the real estate housing market is not merely a collection of properties but a vital component of the social and economic fabric of a community.